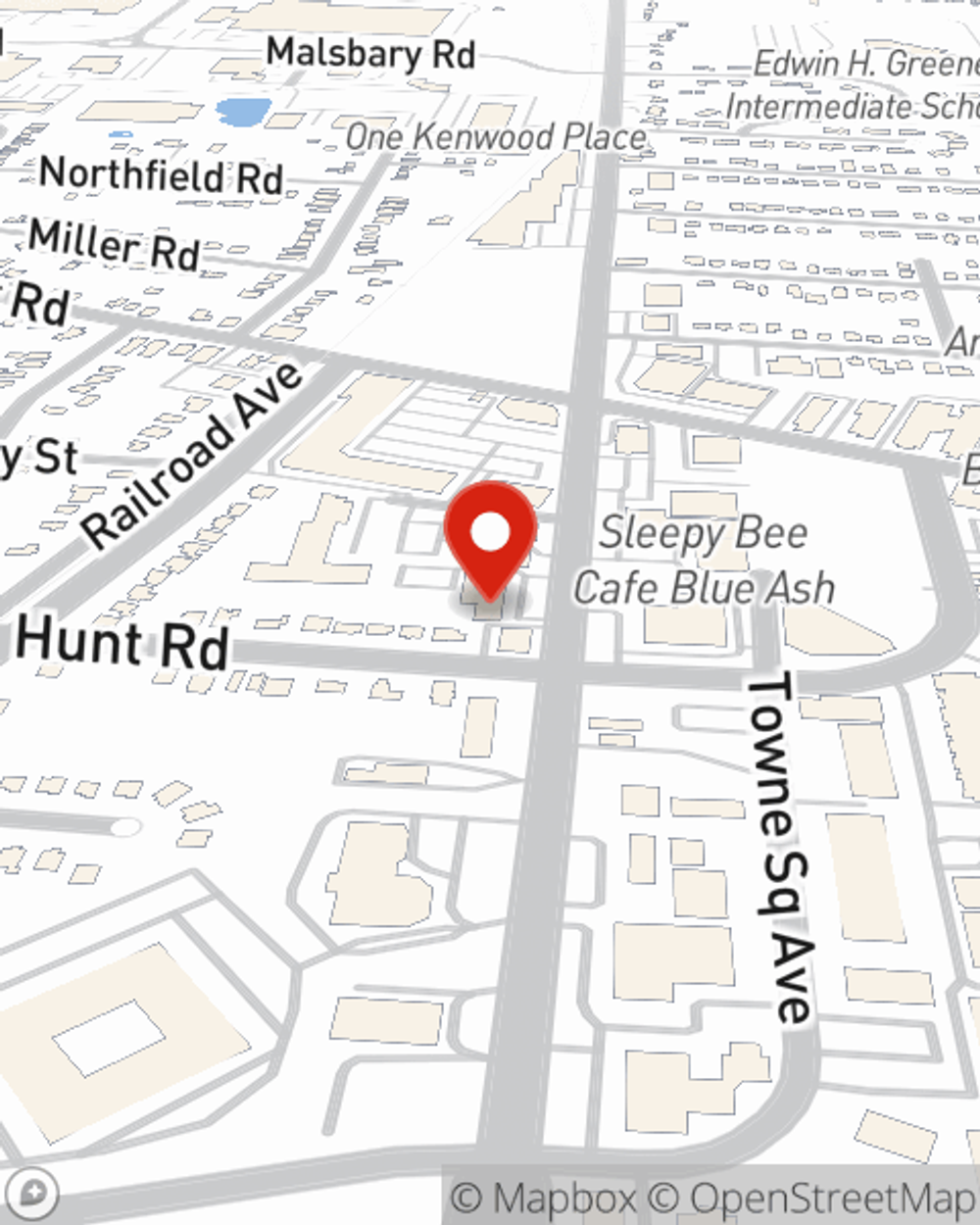

Business Insurance in and around Blue Ash

One of Blue Ash’s top choices for small business insurance.

Almost 100 years of helping small businesses

Cost Effective Insurance For Your Business.

Running a small business requires much from you. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, specialized professions, trades and more!

One of Blue Ash’s top choices for small business insurance.

Almost 100 years of helping small businesses

Insurance Designed For Small Business

Every small business is unique and faces a wide array of challenges. Whether you are growing an art store or a dental lab, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent Mike Dailey can help with errors and omissions liability as well as commercial auto insurance.

As a small business owner as well, agent Mike Dailey understands that there is a lot on your plate. Call or email Mike Dailey today to review your options.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Mike Dailey

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.